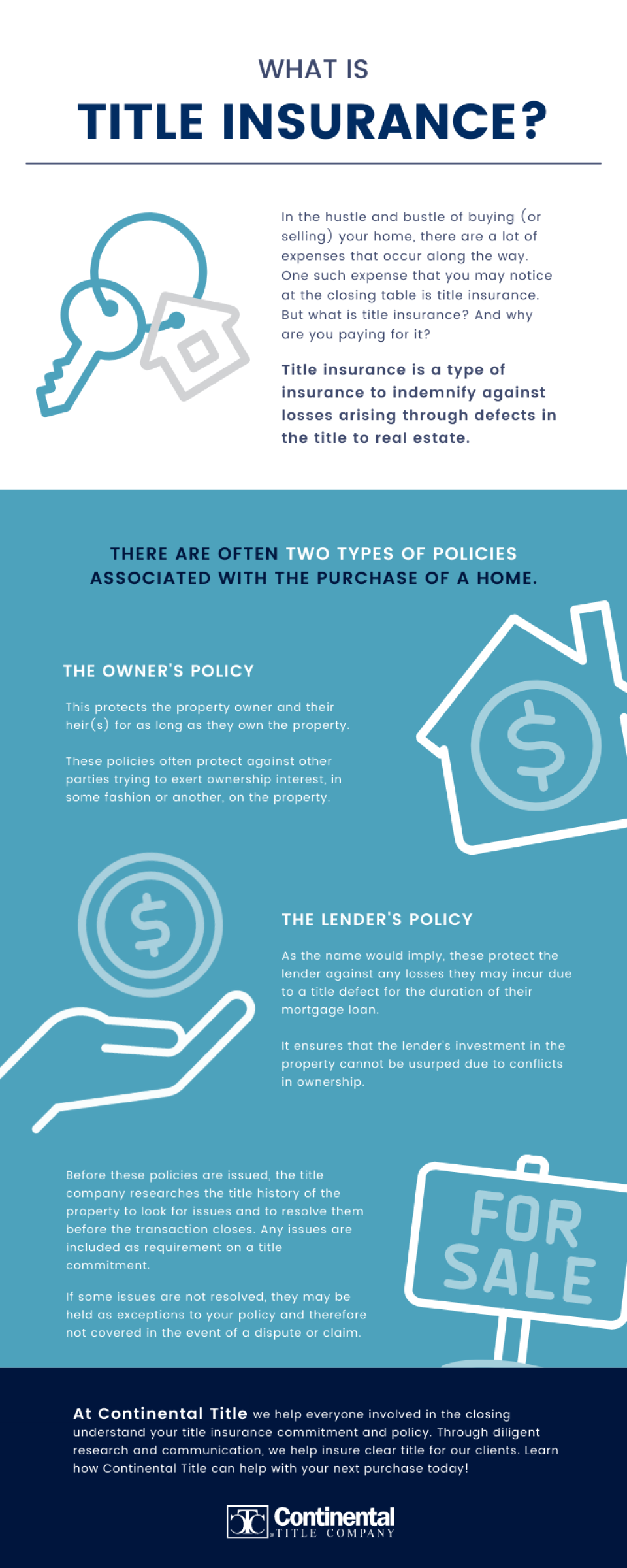

Title insurance is split into two types of policies: Owner's title insurance (aka homeowner's title insurance), which covers the home buyer. Lender's title insurance (covers the mortgage lender) In both cases, the coverage is the same. And whether or not you're responsible for paying both policies depends on the rules of your mortgage.. Title insurance coverage can give homeowners some peace of mind in the knowledge that they'll be excused from legal disputes tied to the property prior to their ownership. A title search is the complete process of reviewing a property's title. It's an examination of public records to determine and confirm a property's legal ownership.

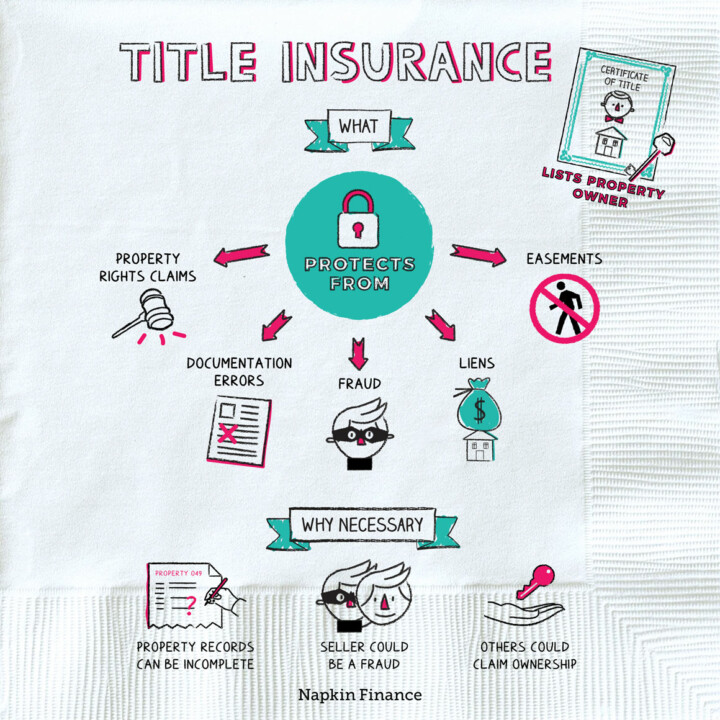

What is Title Insurance? Napkin Finance has the answer!

What Does Title Insurance Cover? Cortes & Hay, Title Agency

How Much Does Title Insurance Cost? Rocket Mortgage

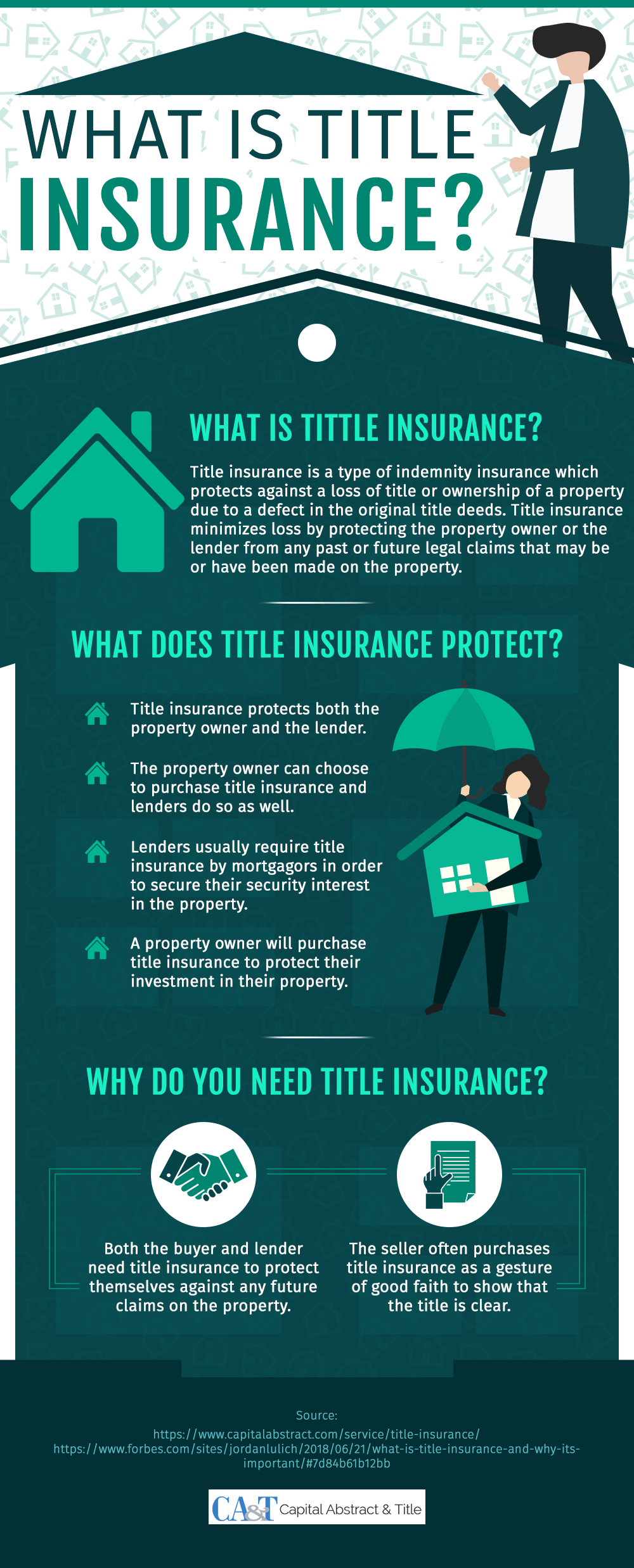

What is Title Insurance? Why Do You Need It?

Title Tip What is Title Insurance?

Why Owner's Title Insurance — Noble

Title Insurance 101 What is Title Insurance & What Does it Cover YouTube

What Does Title Insurance Cover?

What Does Title Insurance Cover? Service Title Agency

Infographic Title Insurance — Scope & Benefits Capital Abstract & Title

Why Are There Two Title Policies On My House? Continental Title Company

What does title insurance cover? Expert advice from a title company in Miami with 15+ years

What Does Title Insurance Cover In Florida Insurance Insight

What Does Title Insurance Cover In Florida Insurance Insight

What Is Title Insurance and What Does It Cover?

What is Title Insurance? Cumberland Title Company Cumberland Title Company

What Homeowner's Title Insurance Covers (With Example)

What does title insurance cover title insurance policy YouTube

What is Title Insurance, and What Does It Cover? Blog Consumer's Title Company

What is the Difference Between Clear Title and Marketable Title? Independence Title Inc

Title insurance is a policy that covers third-party claims on a property that don't show up in the initial title search and arise after a real estate closing. A third party is someone other than.. Title insurance is a policy meant to protect home buyers and mortgage lenders from damages or financial losses caused by a bad title due to title defects. Most title insurance policies cover all the common claims filed against a title, including outstanding liens, back taxes and conflicting wills. Many scenarios can cause a title problem, which.